The number of business leaders willing «to whitewash» their practices of tax planning is significantly down in comparison with 65% one year earlier. By this indicator our country is the nearest to France (53%), Japan (53%) and Sweden (39%).

There have been showed the similar results according to the survey concerning the readiness of companies to review their tax policy against background of press attention increasing. In Russia only 15% of respondents are ready for this, in France - 15% too, in the Netherlands - 14%, in Great Britain - 13%, in Japan - 12%, in Sweden - 10%. However «fourth estate» in Mexico (80%), Thailand (72%) and the Philippines (74%) makes businesses pay greater attention to risks.

Indicators on spheres of business also significantly differ. So representatives of hotel industry (82%), financial (80%) and agricultural (80%) sectors are willing to pay more taxes in exchange for clear tax rules. And only 40% of oil and gas companies agree to such terms.

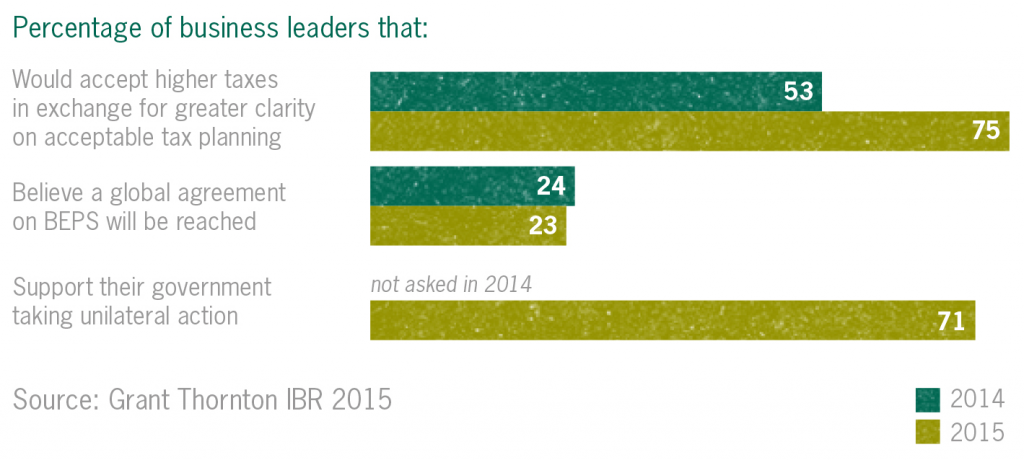

Let`s also remind that Russia is a participant of the Base Erosion and Profit Shifting project (BEPS) accepted in 2013 at G20 summit in Saint-Petersburg and enacted by countries-participants step by step. However according to Grant Thornton International survey only 16% of Russian respondents rely on international efforts efficiency in this sphere. Meanwhile 62% of Russian business leaders support unilateral actions of authorities for the tightening tax control with the different degree of determination.

Totally in this survey there took part more than 2500 business leaders representing various economical sectors in 35 countries.

| Recommend | |

|

| |