“The Day of Tax Freedom is determined by calculating the ratio of the amount of collected taxes to the net national income multiplied by 365 (days). The resulting figure is the number of days taxpayers have to spend on working exclusively for paying taxes. The next day after the expiry of the period thus calculated will be the Tax Freedom Day,” explains Igor Nikolaev, the FBK Institute of Strategic Analysis Director.

The idea of calculation of such index was generated in 1948 and belongs to Dallas Hostetler, an American businessman from Florida. This index is calculated and published in several countries of the world: in Canada - Fraser Institute; in Great Britain - Adam Smith Institute; in Germany – Bund der Steuerzahler; in Bulgaria - Institutе for Market Economics; in Czechia – Liberalni institute, and others. For example, according to the Canadian survey of 2014, the residents of Canada pay all their taxes by 9 June, the information about the provinces is provided there, too (ranging from 23 May to 22 June). In 2014in Great Britain that day occurred on 28 May.

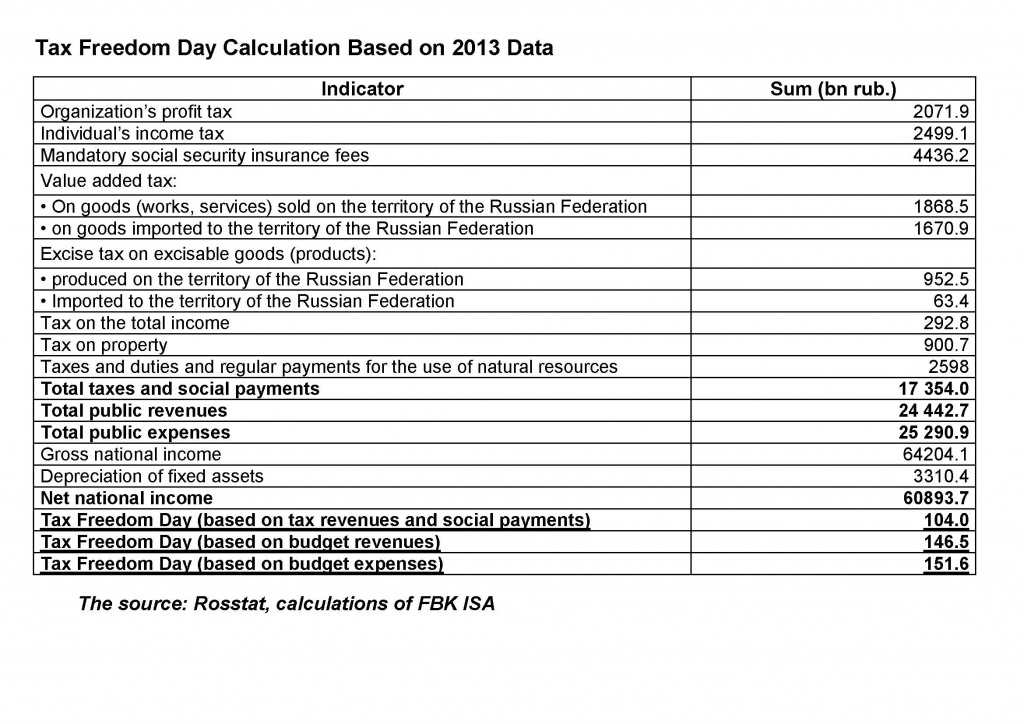

By doing similar calculations with the Rosstat data for 2013 (the official data on the gross national income and fixed assets depreciation required for the calculations for 2014 will only be published late in May 2015) we have:

• The tax yield and social payments received by the budget amounted to 17,354 billion roubles;

• The net national income calculated as the difference between the gross national income and fixed assets depreciation amounted to 60, 893.7 bn roubles;

• The indicator – Tax Freedom Day – defined as the ratio of the received taxes and dues to the national income and multiplied by 365 (17354/ 60893,7*365=104,0). The indicator calculated in this way equals 104, i.e., it will take 104 days to pay all taxes and dues, and day 105 (15 April 2013) will be the Day of Tax Freedom.

Tax Freedom Day calculations for 2006-2012 (see Annex) show, first of all, that in Russia the Day occurs in April (except 2009 – March). Secondly, the retrospective data show that the Tax Freedom Day occurred much later in 2011-2013 compared to the 2000-ies. That is an indirect proof of the growth of tax burden in Russia for the last few years.

Besides a formal approach to the calculation of the Tax Freedom Day, which based on the definition of the indicator means using in the numerator of budget tax revenues and social payments only, other options for calculating the Tax Freedom Day should not be omitted. Such options suggest besides tax budget income using the non-tax budget revenues or even the amounts of public expenses.

Taking into account the non-tax budget revenues (the total public revenue in 2013 amounted to 24, 442.7 bn rubles) allows determining the day in the year when taxpayers (in the wide sense of the word) cease earning for the needs of the state and begin earning for themselves. Such version of calculating the Tax Freedom Day is used in many countries, for instance in Australia, India, Czechia, though it should be more fair to call it the Day of Fiscal Freedom. This approach would have moved the Tax Freedom Day in Russia to the 147th day of the calendar – 27 May (2013). Such a significant shift is basically due to the essential contribution of income from the foreign-economic activity, specifically customs duties, to the non-tax state income. It is worth noting that in many foreign countries customs duties are considered as varieties of indirect taxes.

In other countries, for example, an independent research company Tax Foundation in the USA, besides the formal version of the indicator additionally calculates the Tax Freedom Day on the basis of public expenses, which also makes it possible to take into account the budget deficit or to eliminate the effect of passing the current public expenses on to the future generations. The use of such approach (the total public expenditures in 2013 amounted to 25, 290.9 bn rubles) would make it possible to consider the 152-th day, i.e. 1 June as the Day of Tax Freedom in Russia (and in the USA, for example, in 2013 – 129-th or 9 May). In India the Center for Civil Society calls that day the Day of Freedom from the State.

| Recommend | |

|

| |